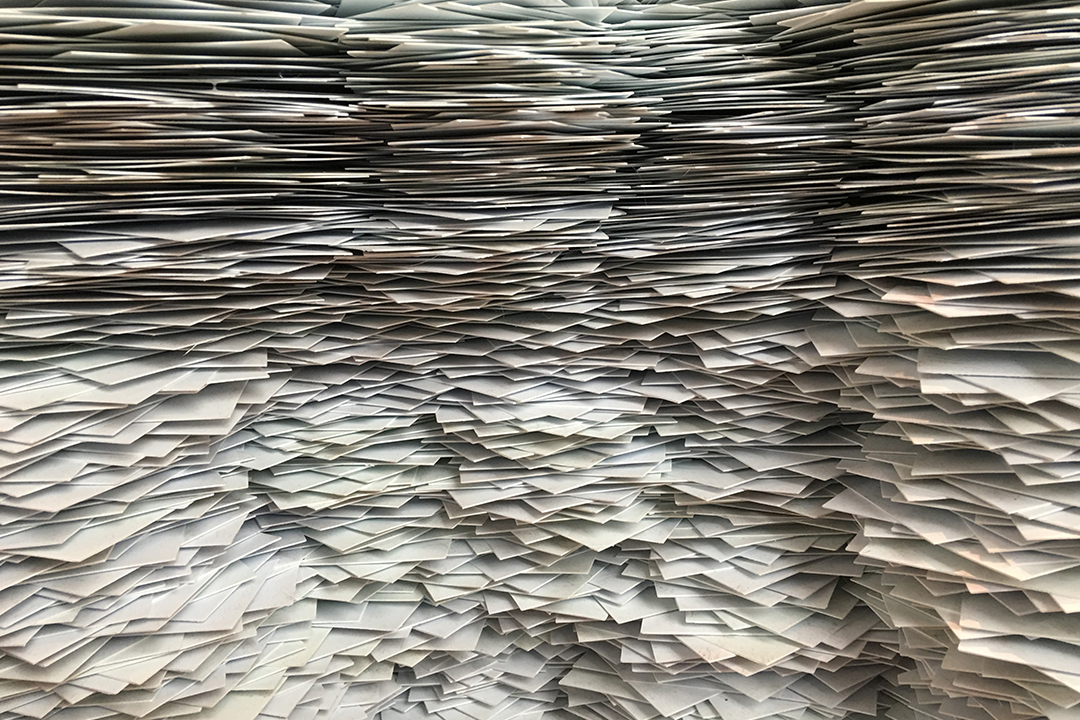

Paper Documents such as Payroll Records may seem just a bunch of paper trash or litter paper. However, these files holds an important role in every business. Through these, many problems have been solved and many companies were saved from huge trouble.

The Labor Code and other existing laws must be followed at all times. But in times of conflict with any of these, your major weapon that you can use to avoid penalties and punishment are the documents that you properly collected. But, this can only be used to prove the legitimacy of your processes, actions and company guidelines. Remember that you must not falsify or use made-up documents to cover up bad deeds for this is what will lead you to bigger trouble.

Now, it is important to be aware of the format in which these records need to be kept varies by agency. We’ll provide a best practice list of payroll documents to keep with detail on how long to keep payroll records in order to meet the various, and sometimes conflicting, requirements.

What to Keep & For How Long?

Unlike most papers such as job applications and interview records which need to be kept for only a short period of time or not more than a year, payroll documents should be kept for longer than a couple of years once a person is hired. Best practice examples of documents to retain include hiring documents that provide the employee’s full name, address, and social security number, as well as I-9 forms, time cards, and pay-stubs.

Best Practice Document Retention

This includes tax documents that need to be kept for as long as half a decade and retirement income documents that need to be retained for more than half a decade. In addition, In case you have a termination dispute with an employee, it’s a best practice to hold on to payroll documents until the dispute is resolved.

How to Store Records

Usually, there are three storage options for payroll records that you need to keep. You could keep the files yourself, box up or you can even store the paper files offsite, or maintain the documents and data electronically. Here are some considerations for paper versus electronic payroll file storage.

Required Payroll Information on Paper Documents

There are storage companies that will maintain your paper documents securely if you don’t have room to keep them onsite. The benefit of a secure off-site storage facility is that you don’t have to worry about storage space, or maintaining confidential health information such as leave request forms, from being accessible to staff.

Required Payroll Information Electronically

Most HR and Payroll software has document storage capabilities, either allowing you to upload scanned files like I-9 forms. Or you can input employee data directly into the system. In fact, Gusto manages all on-boarding and payroll documentation electronically … keeping all of your required files in one place and making document retention easy.

There are also companies that store electronic data for you. However, you’d need to verify the online data storage account is secure because payroll data contains sensitive information like birth dates, bank accounts, and social security numbers.

Also there area lot of software and apps that you can utilize to store your documents safely. As simple as that, you can now have a better and safer payroll information storing system for your business.